Jump to winners | Jump to methodology

Enabling people to work better

Paradoxically, for America’s best insurance leaders, the biggest challenge this past year has been juggling so many challenges at once.

From rising reinsurance costs and severe weather events to carriers pulling back from key markets and shifting regulations, the hurdles kept coming. However, the biggest factor within their control has been addressing talent shortages and employee gaps, which have been exposed by a new generation of ultra-connected customers who expect lightning-fast service.

“Leaders have been forced to make peace with chaos. To adapt faster than regulation allows. To rebuild trust in an age when headlines travel faster than help,” says Jeff Arnold, founder of RightSure.

The Jacobson Group’s president, Corey Pinkham, paints a similarly tough picture of the situation facing industry leaders.

“Organizations are being hammered by high costs, inflation, and large payouts from recent catastrophes – seeing their margins and profitability constrained. At the same time, there’s increasing pressure for leaders to make high-cost technological investments to stay competitive, specifically in AI,” he says.

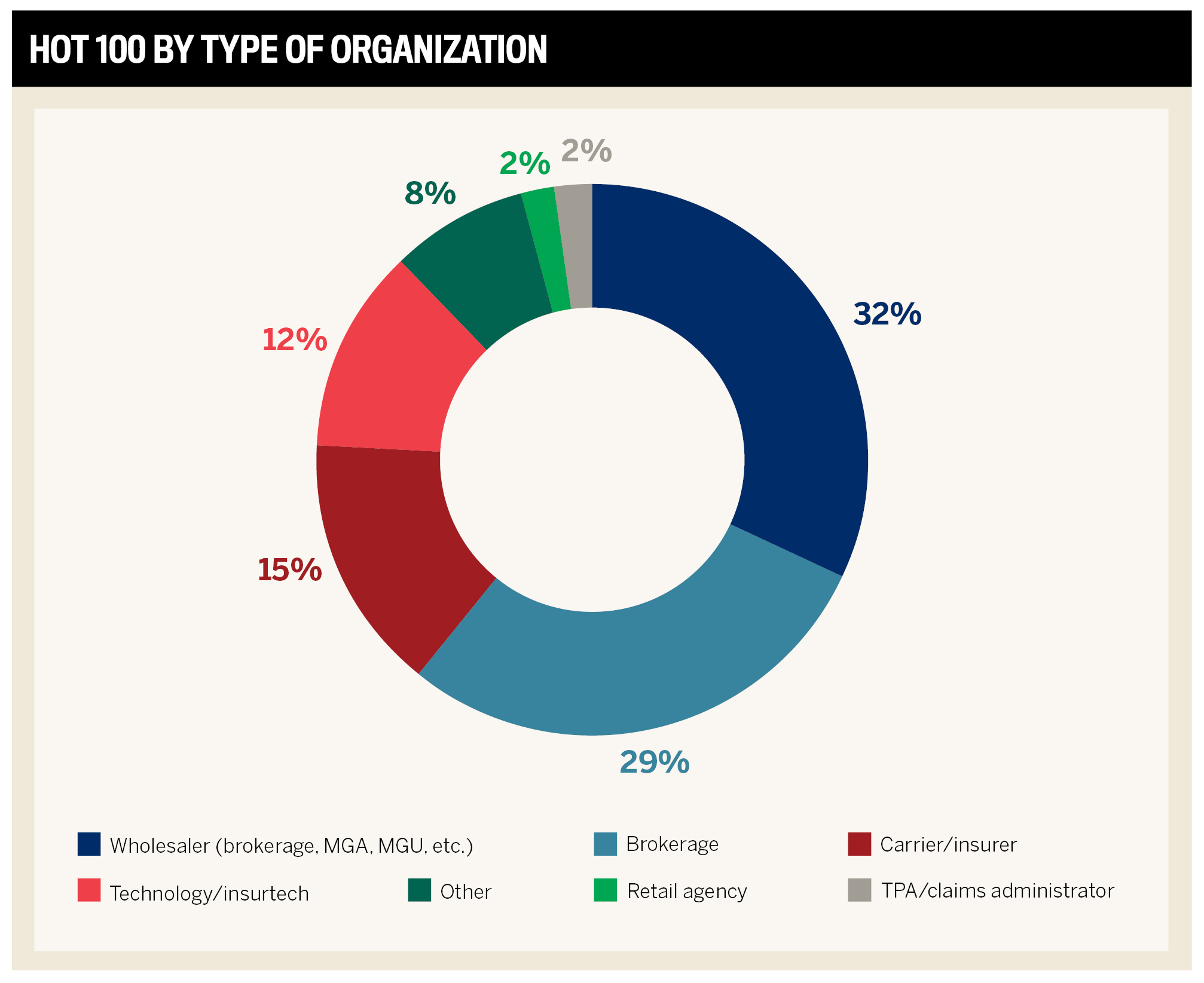

Insurance Business America’s 11th annual Hot 100 list honors those who have risen to the challenge and overcome the hurdles on their path. The 2026 list was narrowed down to those who have shaped the insurance industry over the past 12 months and are the best the industry has to offer.

Solving the talent problem

A commonality among IBA’s Hot 100 has been dealing with employment issues.

Zippia research suggests that the average insurance agent’s age is 46 years old, while the US Bureau of Labor Statistics predicts that nearly half of the insurance workforce will have retired by 2038.

Some are impacted by a talent gap and not seeing enough candidates with the necessary skills. However, the prevailing situation is leaders unlocking talent sources with initiative solutions and coupling that with leading-edge tech to fully leverage their team’s skills.

Chief Financial Officer

Heffernan Insurance Brokers

Location: Walnut Creek, CA

Hitting $2 billion in premiums in 2025, up from $600 million just three years ago, is a testament to the powerhouse performance of the firm’s finance team. Along with playing his part in the rise, Mortimer has faced retirements and addressed this by rebuilding the team from the ground up.

“The way it worked before was there’s a team, everybody doing a bit of everything,” says Mortimer. “So, in the first year, I really wanted to define the roles and responsibilities and make sure people understood what they owned. When you give ownership and accountability, there’s a sense of empowerment that they can control what’s going on.”

As CFO, Mortimer guides guides the business in a fiscally responsible way but also makes a point of understanding where the firm is going.

“If you’re always going to say no, you’re not going to get a seat at the table. You need to be understanding and hear other people’s perspective and communicate at a level that they understand when it comes to finance. You want to make sure that you’re communicating in a way that they feel that when they have concerns, they’re heard,” he says.

“I have to be myself in this role and bring my own skill set, but I need to also have a team around me that can really help with my shortcomings”

Philip MortimerHeffernan Insurance Brokers

Mortimer has also shifted the view of the finance department’s role.

He explains, “When I came in, my goal was to move us from a back-office function to a business partner. The only way you can really do that is to make sure that everyone feels empowered to bring their ideas to the table.”

Mortimer has encouraged this practice from day one and frequently does one-on-one meetings to keep his finger on the pulse.

“I ask the team, ‘Where do you want to be in a year or two years?’ I blend that with what the company is going to need as we move forward from a strategy perspective. I always want to make sure that the people here have the first opportunity when new roles come up and new asks are required from the business.”

Keeping this pipeline of talent alive is a priority for Mortimer, but he never loses perspective on what the company needs. The strategy is to align both initiatives.

“We’re always talking about, ‘What’s the plan? Who’s the next person up?’ And if the plan needs to change for whatever reason, we can pivot. We’ve identified some top talent here at Heffernan who are ready to take that next step in their career,” he says.

President of US Loss Adjusting

Crawford & Company

Location: Peachtree Corners, GA

Crawford & Company’s GTS team has undergone 250 percent growth over the last three years by focusing on addressing increasingly complex and larger losses with specialized talent and a team-based approach, enabling faster and more effective claims management.

To achieve this and address the talent gap, Crawford & Company revamped its Protégé Program, which reduces the process to become an executive general adjuster from 10–15 years down to around five. The program attracts talent of varying backgrounds, some of whom are straight out of college and others already working in other industries.

Kottler says, “They are not mid-career because it’s the younger crowd that’s joining, but they’re very smart, and we pair them with our executive general adjusters or managing executive general adjusters. They’re getting on-the-job training from day one.”

“We specifically target talent and bring them in. We have CPAs, investment bankers, typical Wall Street types, and academics joining our ranks”

Paul KottlerCrawford & Company

With three decades of experience, he recalls when insurance companies didn’t train their own people.

“With the escalation of losses and the size and complexity of the policies, we’ve really needed to close that gap. And the Protégé Program allows us to quickly get people into higher-level positions,” he says.

Bringing in this type of talent with varied degrees and industry experience (e.g., finance, law, engineering, and technology) has made the claims teams more adaptable and capable, with younger professionals driving technological adoption and operational efficiency.

Another of Kottler’s initiatives was the successful relaunch of the Ocean Marine Division, facilitated by securing specialized talent and a targeted, expertise-driven approach, recognizing the complexity and importance of marine and inland transport in global trade.

“It’s something that we’ve had our eye on, but you have to have the experts to do it. It’s a very specialized skill set,” he says.

The team is aware of international implications, but also all of America’s domestic waterways transporting everything from oil to grain supplies.

Kottler says, “The majority of goods are transported by water in and out of the US, and we have some of the largest ports in the world on both sides of the country.”

Chief Executive Officer

MSIG USA

Location: New York, NY

McKenna has headed a team that has seen remarkable growth in both profits and talent, with the aim of servicing Fortune 3000-level companies.

MSIG USA’s recent product expansions have been driven by leveraging its global network, financial strength, and underwriting talent to enter markets where these differentiators matter, with a focus on thoughtful, long-term growth.

“We’re an organization that’s been around for over 350 years. We want to make sure that we’re going to be here for the next 100 years”

Peter McKennaMSIG USA

There has been impressive growth across the team, as 180 people were hired in the last 12 months, with 13 executive leaders. Discovering this wave of new talent has allowed MSIG USA to be on the forefront of the industry’s digital revolution.

“Modernizing the underwriting experience has attracted us a lot more people, especially the younger folk,” McKenna says. “It allows us to monitor the business more efficiently and change course if we need to, if things in the marketplace are changing against us.”

Part of this modernization has seen the vast majority of MSIG USA’s top leaders replaced over the last 18 months. McKenna describes the environment as “new blood everywhere”.

The new senior leaders have been selected for skills outside of their core insurance roles, so they can ensure the firm has a talent pipeline to enable it to continue thriving for years to come.

“They are all recognized within the industry as being very competent in their roles, but also have good reputations for working in creating team environments,” says McKenna. “They have built businesses before, but what I’m most proud of is how they’re spending a lot of time with these younger folks. They’re training them up and the most impressive thing is we’re changing the culture at this organization.”

Shareholder and Chair

Greenberg Traurig’s Global Insurance Regulatory and Transactions Practice Group

Location: Fort Lauderdale, FL

Leading by example and ensuring his team is able to develop is a focus for Karlinsky.

He says, “I want my team to work hard, and I want them to be knowledgeable about issues. I try to be the hardest working guy on the team.”

He keeps everyone sharp by making sure they’re always in the loop on the latest industry news and trends. With his commitment to constant research and staying informed, Karlinsky ensures his team is one step ahead.

“I believe in leading by example when it comes to talent development. I strive to set a standard for hard work, and I encourage my team to stay constantly informed and engaged with the issues our clients face”

Fred KarlinskyGreenberg Traurig’s Global Insurance Regulatory and Transactions Practice Group

“It requires a lot being at the top of your game all the time. That’s what I expect from myself and that’s what I expect from the team, and when the team gets to that point, they’re positioning themselves best for professional development as well as for helping our clients,” he says.

Another point that Karlinsky advocates is specialization. He encourages employees to become more than generalists so they can offer defined value.

“We don’t see a lot of cases of first impression, and even when we do, there’s some semblance of a lot of things we’ve done before,” he says. “Specializing to me is an important component of being the best professional you can be and being efficient for clients.”

Power of AI and technology

Skills shortages are being solved not only by innovative recruitment but by tapping into tech. IBA’s Hot 100 are supporters of using systems and platforms to drive efficiencies and bridge the talent gap.

Pinkham lays out the complex and evolving nature of the current market in the US.

“There’s increasing pressure for leaders to make high-cost technological investments to stay competitive, specifically in AI. Not all leaders need to be AI experts, but they need to familiarize themselves with it and focus on building teams that possess the specific technology,” he says.

Arnold believes future leaders will have to be “part technologist, part humanist”.

He explains, “An exceptional leader in the insurance industry of 2026 isn’t measured by policy counts or premium volume. They’re measured by the human impact they create – in how they merge technology with trust and data with empathy.”

Arnold states that the most pressing challenge is integrating new AI-driven tech while remaining focused on client outcomes.

“We’re watching an industry once defined by paper and patience transform into one powered by prediction and personalization,” he says. “AI and automation are no longer buzzwords, they’re the backbone of modern operations. It’s not about who has the newest tool – it’s about who can connect the dots best. Systems talking to systems. Leaders learning to lead through data and not just around it.”

Kottler spoke of how technology is important but isn’t as cutting edge as some expect. He says, “The efficiencies of technology insurance are still decades behind other industries, but I think it is catching up, and introducing these newer folks into our business is really going to make it excel.”

He also notes that while the speedier and more accurate access to information has increased efficiencies, the technical skills and human judgment necessary to be a high-level adjuster remain the same.

One form of tech that has greatly improved Kottler and his team’s capabilities is the use of drones and satellite imagery to rapidly assess claims.

“If we have a data center that’s a $100-million loss, we’re putting drones on it immediately to calculate the square footage. We’re asking, ‘What is the damage? What experts do we need to get on it?’”

Mortimer also ensures his team is well-versed in the latest tools to enhance their capabilities.

“If the transactions are the same, we need to be looking at AI, and we need to be looking at technology to be able to do those quicker,” he says.

One AI-powered tool is Comulate, which allows Heffernan to automate the reconciliation process. It uses a combination of OCR technology, machine learning, and AI to bring forward a process that used to take days to an hour.

“We’re trying to do that to free the folks. We pose questions to account managers, commercial lines managers, and other executives, such as, ‘What is the information you need to see to make the best decisions?’ We wouldn’t have been able to do that before because we just wouldn’t have had the time,” he explains.

Mortimer stresses how tech and people can come together in a perfect storm.

He says, “I see there’s so much talent on the team and there’s so much more we can do. If we leverage these types of technology, we can truly bring the business forward as a partner and provide insights that maybe we wouldn’t have had time previously to provide.”

Mortimer’s team is also using Workday Adaptive Planning, an EPM software that has allowed them to increase efficiency in financial reporting, budgeting, planning, and revenue analysis.

Karlinsky highlights the possibilities for improved speed and accuracy within claims, fraud detection, and underwriting due to AI. He does, however, emphasize the importance of diligent use, with human oversight being a crucial component of technology adoption.

“You certainly need to make sure there isn’t any unintended bias or unintended consequences. And you need to make sure that human eyes are on things when they need to be on them,” he says.

While AI implementation has drastically changed many roles within insurance, McKenna explains that underwriting capabilities have seen a drastic shift, with underwriters now able to assess risk through a faster process and more complete data.

“What we’re trying to do is build a data-driven platform. Our underwriting workbench is a hundred percent electronic, so the underwriter doesn’t have to look through troves of documents. It’s all AI ingested.”

McKinsey’s “The future of AI in the insurance industry” report highlights fraud detection through advanced data analytics as a pertinent opportunity for insurance firms to capitalize on. This is an area where MSIG is active, with McKenna noting the need to root out fraudulent claims to remain profitable.

McKenna also highlights that MSIG USA is not burdened with the legacy tech systems that some other firms operate under, which has allowed for smooth implementation of new technology.

He adds, “We’ve been able, over the last year, to collapse a lot of this into one component that we’re classifying as our enterprise data platform. That’s allowing us to have finance, operations, claims, and underwriting in one ecosystem. Not separate ones coming together, but all in one, which allows for better speed and consistency.”

McKenna believes there is no lack of talent, but concedes there is a need to do more with fewer people in the modern industry.

“It’s important to know who we are attracting to fill our roles. When I talk about data-driven insurance companies, what we’re trying to do is enabling the underwriting to take place in a much more thoughtful way.”

Conclusion: the Hot 100’s strategy for building high-performing organizations

The 2026 Hot 100 honorees have distinguished themselves by successfully navigating a turbulent industry facing challenges from all directions. These leaders have enabled their organizations to thrive under difficult circumstances by finding new talent to enable higher performance, along with supercharging the existing talent within their ranks.

-

Integrating technology and human skills: merging technology with trust and data with empathy while focusing on the human impact

-

Accelerating talent development programs: fast-tracking talent through structured mentorship and training, allowing high-potential individuals to reach leadership positions quicker while also infusing the organization with new perspectives

-

Modernizing systems to attract and retain talent: making firms more attractive to younger professionals and allowing adaptation more quickly to market changes, supporting both operational efficiency and talent retention

-

Promoting collaboration and business partnership: empowering teams to contribute insights and drive company strategy, further unlocking talent potential