In foreign trade, cargo is carried not only in containers, but also in responsibilities, documents and often misunderstandings. So, who really is responsible for any damage that may occur during transportation? Should the sender or the recipient have insurance? Whose property, whose risk? The answers to these questions are often determined by INCOTERMS (International Commercial Delivery Terms).

What is INCOTERMS Used For?

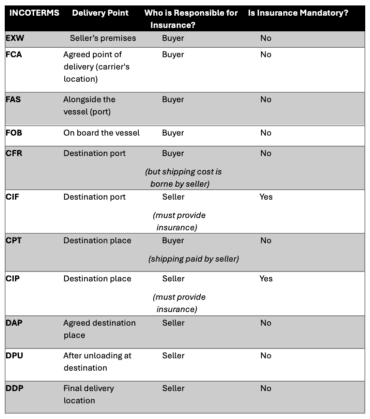

INCOTERMS are the common language in global trade and help to clarify the buyer-seller’s responsibilities. Terms like FOB (Free on Board), DDP (Delivered Duty Paid), or EXW (Ex Works) specify who is responsible for the products and up to what point. But remember: Common language is also open to misunderstanding.

Delivery Method = Liability + Risk + Insurance?

No. It is often thought that way, but the truth is not that simple. INCOTERMS only cover the transportation, delivery and customs processes of the goods. Insurance is left as an “optional” element in most terms. Only CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid To) terms make insurance mandatory. Insurance is a gray area in the remaining delivery methods. And, that gray area is where the “insurance wars” begin.

Insurance Wars: Who Should Have It Done?

Example 1: FOB (Free On Board)

- The seller carries the goods to the ship.

- The risk passes to the buyer when the goods are loaded onto the ship.

- Whose business is insurance?: The buyer’s. Because the risk has passed to them.

- However, the seller can still have insurance to ensure customer satisfaction. This can later lead to “I expect compensation” crises.

Example 2: EXW (Ex Works)

- The goods are received from the seller’s warehouse.

- The buyer assumes all transportation and risks.

- Whose business is insurance?: Clearly the buyer’s.

But in practice, most buyers cannot organize this process, the forwarder intervenes, and confusion ensues.

INCOTERMS Do Not Cover Everything

INCOTERMS are not insurance policies. Saying “It says FOB, so I am not responsible” does not always work. If compensation is requested from the carrier, you or the customer as the forwarder must provide sufficient documentation and evidence. Many parties assume that INCOTERMS are not only “delivery methods” but also “insurance intent”. This assumption is where the problems begin.

What to Do?

1. Add an Insurance Clause Clearly to Contracts:

INCOTERMS are not enough. Who will have insurance, the scope of the policy and the addressee should be clearly written.

2. Clarify the Risk Transfer Point:

The answer to the question “On the ship, in the port or at the border?” changes a lot.

3. Examine the Policy in CIF and CIP

Do not relax because there is compulsory insurance. The coverage may be limited.

4. Inform the Parties:

Inform the seller and the buyer about the risk dimensions of the delivery methods. Conscious customer = Less crisis.

INCOTERMS is the cornerstone of trade, but it is not a castle on its own.

Insurance, on the other hand, is a castle wall. Each delivery method carries its own risk transfer; however, the party who manages that risk often acts with uncertainty. And remember: It is not important who owns the goods, but whose pocket the damage will burn.