Do you want to retire early? Five years ago, I interviewed a woman who did something most people only dream about – she retired at age 30 with $500,000 saved. Her story quickly became one of the most popular posts on my site (you can read it at How I Retired At Age 30 with…

Do you want to retire early?

Five years ago, I interviewed a woman who did something most people only dream about – she retired at age 30 with $500,000 saved.

Her story quickly became one of the most popular posts on my site (you can read it at How I Retired At Age 30 with $500,000) because it showed that financial independence doesn’t require winning the lottery, creating a million-dollar business, or working nonstop. She simply saved consistently, job-hopped strategically to increase her income, and invested in low-cost index funds until she had enough to walk away from full-time work.

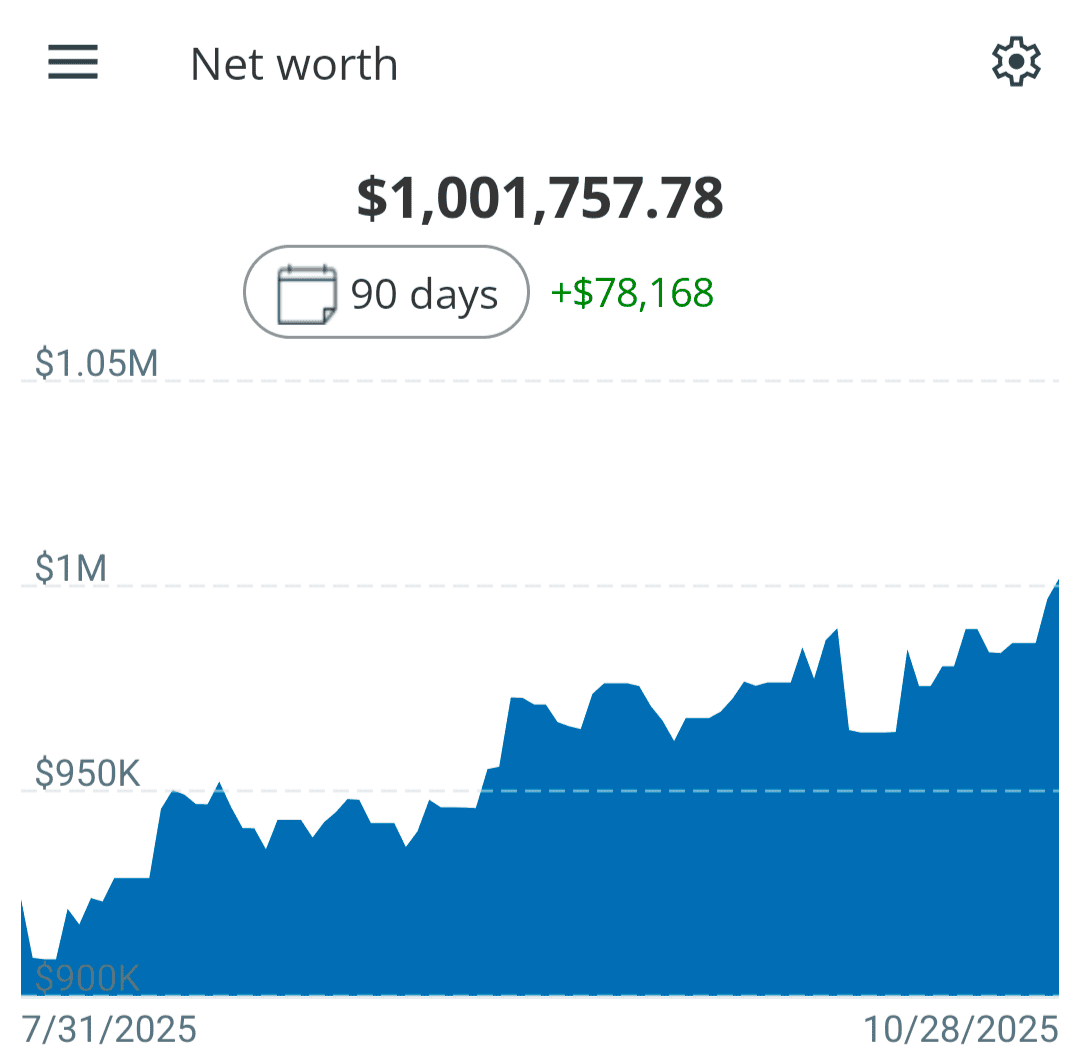

Since that interview, she’s continued to share her journey online, inspiring thousands of people who want more freedom in their own lives. Today, she’s back with an exciting update: five years after retiring early, her net worth has doubled to over $1,000,000 – without adding a single new dollar to her investments.

In this new interview, she opens up about how her money has grown since retirement, what she’s learned from five years of living off her portfolio, and how early retirement has changed her outlook on life, happiness, and what “enough” really means.

In this interview, she answers questions like:

- How were you able to retire at age 30 with $500,000?

- Are you happy in early retirement?

- Since retiring early, have you earned any income or are you fully living off your investments today?

- What is your withdrawal strategy? What is your withdrawal rate?

- How did your net worth grow from $500,000 to $1,000,000 since retiring early?

- What do you do for health insurance?

- If the stock market dropped 30% tomorrow, what would you do?

And more!

This interview is packed full of helpful information on retiring early.

P.S. If you’re aiming for early retirement too, I highly recommend that you sign up for Empower (formerly known as Personal Capital) if you are interested in gaining control of your financial situation. Empower allows you to aggregate your financial accounts so that you can easily see your financial situation. You can connect accounts such as your mortgage, bank accounts, credit card accounts, investment accounts, retirement accounts, and more, and it is FREE.

How I Retired 5 Years Ago With $500,000 And Now I Have $1,000,000

Before we jump into the new questions, here’s a quick recap of who she is and how she originally retired at age 30 with $500,000. This is the story she shared in our first interview:

“Hi y’all! I’m “Purple” from APurpleLife.com. I was born and raised in Atlanta. I went to college in the northeast and then moved to Manhattan and began my career in ad agencies, Mad Men style.

A few years later, I moved into marketing and stayed in that industry for the duration of my career. In 2012, my partner introduced me to the idea of financial independence and I’m very embarrassed to say that I basically dismissed the idea.

It took two years of job hopping before I decided to hear him out. I had convinced myself that if I just found my dream job that I would be happy enough to work for another 40+ years, but then I got that dream job…and I still didn’t want to keep working for decades in this high stress career.

So I joined the FI-community and lurked for years while writing my blog in private to catalog my journey. I started my journey to financial independence and my blog in January 2015 and then moved to Seattle that summer. In July 2018 I took my blog public and in October 2020 I reached my financial goals and quit my job to retire at age 30.

I chose my retirement goal of $500,000 invested, by analyzing my annual spending ($18,000 in Seattle) and adding an 11% buffer on top of that. The way I came to that amount was by backtesting what would happen if I had retired with that amount during any 70 year period in the past.”

Now, let’s move on to the new interview and her $1,000,000 update…

1. For new readers who may be meeting you for the first time, can you share an overview of how you were able to retire at age 30 with $500,000? What steps had the biggest impact in helping you reach early retirement that fast? Why did you choose $500,000 to retire with?

Sure! Here’s what I did:

- Analyzed Spending – I started tracking my spending with YNAB, trimmed every expense that wasn’t bringing me joy and kept the rest.

- Increased Income With Job Hopping – I had 6 Marketing jobs in 9 years. I started making $35K in 2011 and retired making ~$115K in 2020. I increased my salary ~$20K each job hop.

- Used Domestic Geo-Arbitrage – I moved from Manhattan to Seattle and in doing so led an even more luxurious life for about half the annual cost. My spending dropped from $35K to $18K without a change in lifestyle.

- Invested In Low Cost Index Funds – I taught myself DIY investing with library books and then invested in VTSAX (Vanguard’s Total Stock Market Index Fund).

- Hit My Investment Goal & Retired! – Based on my spending over several years I calculated how much I would need to retire. Once my investments hit that amount I quit!

I don’t think one step had a bigger impact than the others – they’re all interconnected. Analyzing my spending made me realize there was a lot of money I was spending on things that didn’t make me happy that I could instantly cut, such as always eating at restaurants. I taught myself to cook, saved a lot of money, learned a new skill and was healthier as a result.

That spending analysis paired with job hopping meant that I had a lot more money to invest in index funds, which sped up my time to retirement. Originally when I was living in Manhattan, I calculated that based on what I was making and spending (this is before the YNAB analysis and spending cuts) I could retire in 10 years. However, after making all the changes above I retired in 5 years.

If you’re curious how I knew retiring at 30 with $500,000 would be enough for me, I wrote an entire essay long post about that below, but the TL;DR is: because the math worked for me 🙂 .

Since I retired 5 years ago, my life has been going better than forecasted financially. At the time of this writing, my net worth recently hit a million dollars – I’m a black female millionaire.

2. Why did you want to retire early? Are you happy in early retirement?

I decided to retire after getting my dream job and realizing that I had done everything everyone told me to do and I was still unhappy. After several job hops I found a fantastic boss and a position that was less frantic and allowed me time to think.

It was everything I wanted in a job (I even had a checklist to prove it), but it wasn’t enough. I didn’t want to live the 24/7 stressful life that corporate america requires these days. It didn’t allow me any time to rest let alone remember what I enjoyed doing outside of work. I was completely drained every night and weekend after giving 110% to my job. There was no room for actual “living.”

A few years earlier my Partner had been mentioning early retirement to me, but I had dismissed the idea because I told myself I just needed to find the right job, but then I got it. It checked every box I had written a year prior. And I still didn’t want to do it for another 40 years.

So one day I decided to look into what my Partner had been saying. I dove into books and blogs and it was like getting hit in the head with a sledgehammer. My Mom had retired at 55 and my grandparents had retired at 50 from the military. That was always my default trajectory: retiring in my 50s. I thought “My Mom didn’t even start investing in stocks until she was 40. I have plenty of time!”

Reading about how someone could retire in their 30s blew my mind. It all seemed so simple, but not easy. I didn’t have to wait to live the life I wanted, which would be filled with uninterrupted time with loved ones and travel. I could do it much, much sooner than 65 or even 55.

More concisely and on a more morbid note, the main reason I was so keen to live the life I wanted now is because none of us are guaranteed tomorrow – either for ourselves or with those we love. So I set out to have an amazing life now and later.

As for happiness, I’m the happiest I’ve ever been. And that’s happier than I ever thought I would be because of my clinical depression. Retirement has allowed me the time to do what makes me calm and brings me the most joy, which I am very grateful for.

3. Since retiring early, have you earned any income or are you fully living off your investments today?

I’ve been living fully off my investments as in I’ve withdrawn the planned amount from my investments each year ($20K + taxable dividends withdrawn annually since 2023 when my original cash cushion ran out). However, in addition to that, I have made some accidental income.

That includes things like Ally interest, which has been way more than I anticipated. For example, Ally paid me $1,205.36 in 2024 just to hold my savings account. They’ve consistently had interest rates of over 3%, which is wild.

As I go into detail about in the post above, I also had other income from blog related activities, which I never expected given that my blog was never meant to be a money making endeavor specifically and also didn’t make any money for years.

I’m in my 8th year of my blog and I’m happy that it’s currently sustaining itself and that it can currently pay for things like better hosting and even a finance event if I decide to attend one again. I’m also grateful that I don’t need this income and therefore don’t care if it goes away for some reason. That’s the freedom retirement brings.

I planned to make $0 of income in retirement, which looking around might have been naive of me since it seems that most retirees accidentally make money somehow especially during a longer retirement.

Even if my blog had continued to lose money, based on how my retirement has been going I think I would have accidentally made money in some other way. If an opportunity to make some cash comes up these days I say no because I want to do other things, like my new knitting obsession this year. Money’s not anywhere near my top consideration anymore.

4. What is your withdrawal strategy? What is your withdrawal rate?

Basically the 4% rule. When running scenarios in cFIREsim (my favorite FIRE calculator), it shows that my original $500,000 invested would be enough to retire even in the worst market downturns of the last 147 years – even for a 70-year retirement.

The only caveat is that this includes decreasing my 4% spending from $20K in 2020 dollars to $16,500 during down markets if they happened at the beginning of my retirement, which would have been an easy feat for me if necessary.

The past obviously doesn’t predict the future, but even I was surprised that reducing my spending by such a small amount in a few cases could lead to such a 100% success rate despite everything our country has been through in the last 147 years.

Based on these calculations, I would have been safe retiring in any of the last 147 years and in many scenarios, I would have finished my 70-year retirement with a great deal more than I started with (inflation adjusted).

Oh and I forgot to mention that this calculation does not assume a spending ceiling – meaning I can spend more than $20,000 (2020 inflation adjusted) if I want or need to. That’s a concept I first read about in the book Work Less, Live More which touts a flexible withdrawal rate of 4% of your current portfolio every year (instead of 4% of your starting amount as the Trinity Study uses). I have tweaked this idea to suit my purposes and was happily surprised at the optimistic result.

These calculations also included me making $0 in retirement, which I’ve already mentioned hasn’t been happening and that I receive $0 in social security, which I doubt will be the case.

5. How did your net worth grow from $500,000 to $1,000,000 since retiring early?

Just from the stock market – I haven’t added any of my money into the market since retiring. Here are all those numbers by year:

- October 2025 Net Worth: $1,001,757

- 2024 Net Worth: $882,223

- 2023 Net Worth: $731,790

- 2022 Net Worth: $607,757

- 2021 Net Worth: $755,790

- 2020 Net Worth: $620,767

- 2019 Net Worth: $448,230

- 2018 Net Worth: $280,884

- 2017 Net Worth: $234,822

- 2016 Net Worth: $137,612

- 2015 Net Worth: $89,450

- 2014 Net Worth: $53,352

- 2013 Net Worth: $29,545

- 2012 Net Worth: $20,439

- 2011 Net Worth: $5,000

I also update my net worth on the below blog page and on Instagram monthly in case you want to follow along: The Numbers

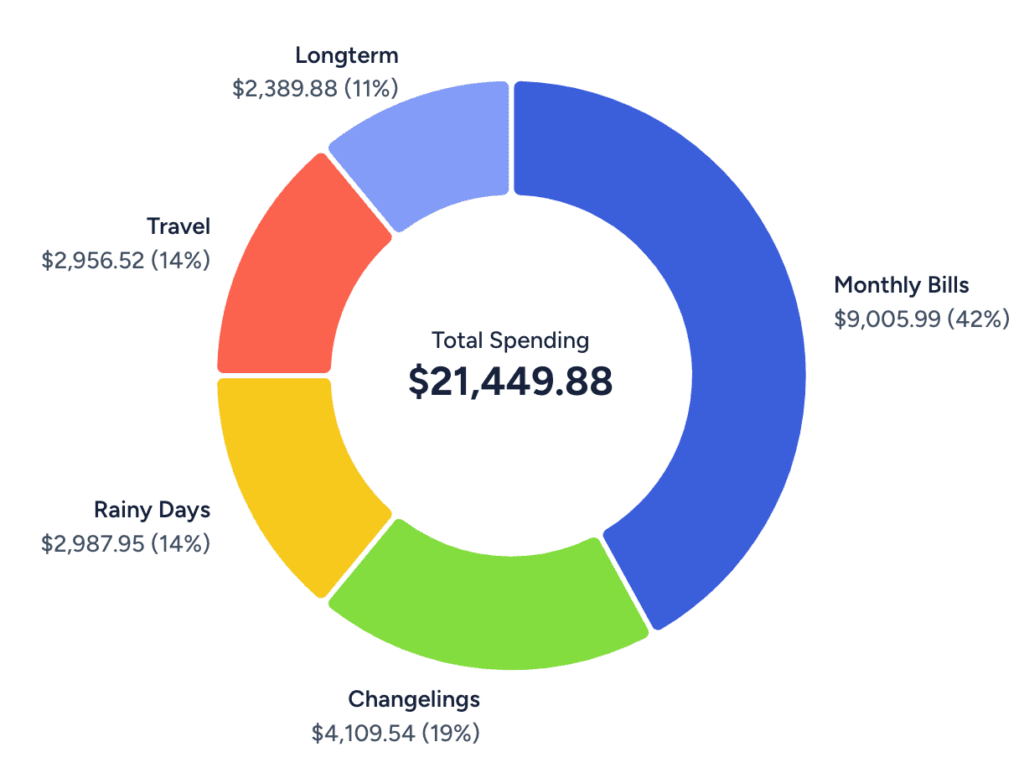

6. How has your spending changed since retiring early? Has it gone up, down, or stayed about the same?

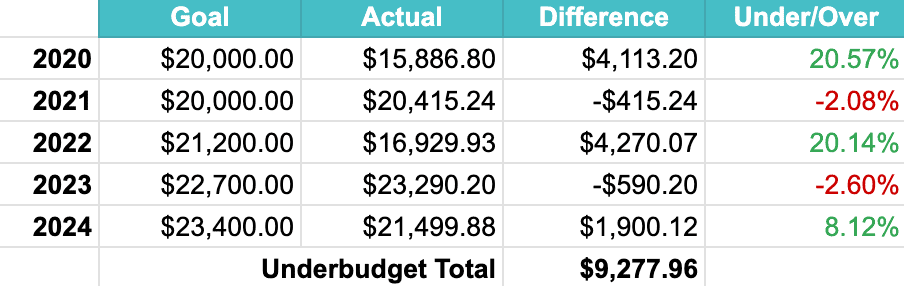

It’s stayed the same after factoring in inflation. Some years I spend more or less, but it evens out and at the end of 2024, I was about $10K under budget for all of retirement. See what I spent every year here:

I’ve also done an annual report of every cent I spend for the last decade in case that’s of interest. Here’s an example of that from last year:

7. What do you do for health insurance?

I’m part of the ACA and I use Safetywing travel insurance when I’m traveling. While I was a full-time nomad, I would get prescriptions in other countries, such as México and Costa Rica for a much lower cost.

I’ve also routinely gotten dental work done abroad and also visited doctors since despite always having health insurance in the US, our wait times and overall care are atrocious, especially for the inflated price this country charges.

8. Are there any big financial surprises you encountered in early retirement?

I’ve been surprised that I was able to travel the world full-time for 5 years, for less than $25,000 a year. I thought going to all the HCOL areas that I have been recently, such as England, Scotland and Iceland would challenge my budget, but it hasn’t. I think booking ahead, being flexible because I have unlimited free time, and buying large purchases like flights based on when they’re less expensive has gone a surprisingly long way.

The other surprise was that I bought a car this year and got an apartment. I hadn’t ruled those things out in my life, but I wasn’t expecting to do them in 2025.

However, the amount I was underbudget that I showed above basically covered all these additional expenses, which was unexpected and awesome.

9. Do you ever feel tempted to go back to traditional work? Why or why not?

Lol – absolutely not.

I never enjoyed Corporate America and everything I hear about it gives me bad shivers. I’m surprised I lasted as long as I did and I am grateful I did since it got me to where I am now, but it was awful and I’ve never missed it for a second.

10. If the stock market dropped 30% tomorrow, what would you do?

Nothing 🙂 . I currently have over 2 years of cash in my Ally account so I’d just keep living my life.

11. Do you keep a set cash cushion for down markets? How much feels right for you?

I originally had a 2 year cash cushion only because I was retiring in 2020 and thought the March 2020 stock market dip would turn into a long down market, but it didn’t. So after the market shot back up and I’d already retired, I started just keeping 1 year of cash.

However, this year since we bought a car and have an apartment and things that might need additional cash quickly I’ve started keeping a 2 year cash cushion again so I don’t have to think about cash flow if a big one time expense comes up.

12. Where have you traveled to since you retired early? What are some of your favorite things you’ve done in early retirement?

Ready for a list? Since retiring I lived in these US States and countries:

US States

- New York

- California

- Washington

- Colorado

- Massachusetts

- New Hampshire

- Texas

- Nevada

- Arizona

- Maine

- New Jersey

- Connecticut

- Illinois

- New Mexico

- Georgia

Countries

- Italy🇮🇹

- The Netherlands🇳🇱

- Switzerland🇨🇭

- Japan🇯🇵

- Perú🇵🇪

- The UK🇬🇧 (England🏴, Scotland🏴)

- Iceland🇮🇸

- Australia🇦🇺

- New Zealand🇳🇿

- Singapore🇸🇬

- México🇲🇽

- Costa Rica🇨🇷

- Canada🇨🇦

- Argentina🇦🇷

- Thailand🇹🇭

- México🇲🇽

I usually stay in one location for at least a month to feel like I’m living somewhere instead of just visiting. This is also a part of slow travel, which I find much more relaxing and enjoyable than the running around I did on vacation while I was still working.

Some of my favorite things that I’ve done in retirement include circumnavigating Iceland, snorkeling in the Great Barrier Reef, learning Spanish in México, feeding Elephants at an Elephant Sanctuary in Thailand, experiencing Singapore Air First Class Suites and flying in a Hot Air Balloon in the largest Hot Air Balloon Festival in the world.

13. Lastly, what is your very best tip (or two) that you have for someone who wants to retire early or reach financial independence?

My best advice is to be honest with yourself. Think about what makes you happy and work towards that – no matter what that is. When I decided to pursue early retirement, I took a hard look at everything I was spending money on. Did that restaurant meal feel worth $250 of my blood, sweat and tears? Could I make the same dish at home for a quarter of the cost with a lot more friends there to enjoy it in an environment that I actually prefer?

At times, the answer to ‘if something was worth it’ was yes, and I kept that in my budget, but a lot of times the answer was no. Those things didn’t make me happier so I eliminated them from my spending and tried to be as intentional as I could about how I spend my money and my time (my most precious resource).

Overall, I’d just suggest figuring out what makes you happy and spend money on that. And to that end, don’t be afraid to be weird and just do whatever you want, even if it’s being an outlier and doing something strange like retiring early. People will judge you regardless so you might as well be happy.

When do you think you’ll retire? What questions do you have about early retirement?

Related content: