In brief

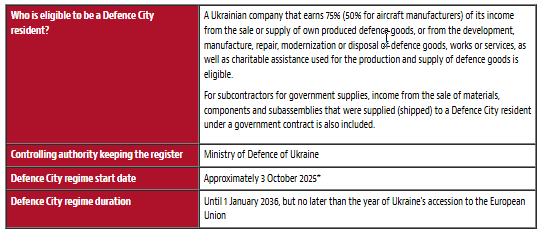

On 21 August 2025, the Verkhovna Rada of Ukraine enacted two significant pieces of legislation — Law No. 13420 and Law No. 13421 — creating the legal foundation for the Defence City initiative. Law No. 13420 on Defence City framework and tax incentives received presidential assent on 3 September 2025.

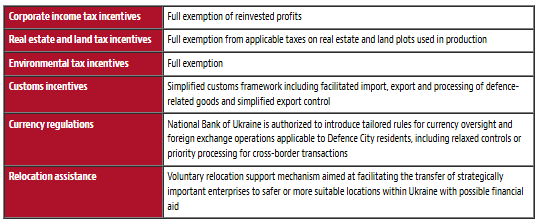

The Defence City initiative establishes a distinct legal regime aimed at fostering the advancement and modernization of Ukraine’s defence-industrial sector. It provides various fiscal, regulatory and operational benefits to eligible enterprises.

Enterprises applying for resident status are required to demonstrate a strategic significance to national defence. The Ministry of Defence of Ukraine will establish and maintain a secure, confidential registry of approved entities. All information pertaining to registered enterprises will be safeguarded in accordance with national security protocols.

Please note:

- The Defence City regime is separate to, and may not be combined with, other preferential tax regimes, such as Diia City, simplified tax and other corporate income tax-exempt status, including charitable organization benefits.

- Transfer pricing rules are applied to controlled transactions under the general terms unless services/goods can be supplied by a so-called exclusive supplier. Defence City residents are responsible for proving that a supplier holds “exclusive” status.

- The value-added tax exemption for defence services and goods supplied to the Ukrainian army is applied under general rules, with limited adjustments.

- Defence City residency requirements restrict the number of business entities involved in defence technologies and products that may be included.

- Compared with the Diia City regime, the Defence City regime is less generous in terms of the tax and legal incentives offered.

- A corporate income tax exemption offered only for the reinvested profits but not for the distributed profits (in the form of dividends) may be a discouraging factor for potential investors.

- Separately, the Defence City regime does not offer research and development credits, liability exemptions and governmental support, which might have made the regime more attractive.

*****

Mariia Tashchi, Associate, has contributed to this legal update.